Basically estate administration entails three steps as follows-. A to call in the deceaseds assets.

Wills And Probate Low Yow Law Firm

When a landed property is sold one year after the death of the deceased.

. In granting the letter of administration the. So basically it all boils down to how the court sees it. The High Court in its grounds of judgment dated 5 August 2019 in the case of United Renewable Energy Co Ltd v TS Solartech Sdn BhdThis is the first Malaysian decision to.

After the transfer of property the executor may now vest the properties in the beneficiaries. Application for grant of probate learn more. Disposal - Citizens - Non.

One of the most common grounds to support such an application would be that all the beneficiaries of the deceaseds estate consented to the sale. Upon the death of a person the deceased a grant of probate is required to authorize a person in representing the deceased namely an executor to transfer the assets or. An exception is where your will expressly provides for an expected marriage in a contemplation of marriage.

Property owned by Husband. The beneficiaries consent will. Where a will has been lost or mislaid after the death of the testator.

Whether on a personal level or in cases where its covered in the news a lot of focus is. For non-Muslims the distribution of assets in your estate if you died intestate without a will will be governed by S6 of the Distribution Act 1958 Amended 1997. A will is a document that sets forth ones wishes regarding the distribution of assets.

So once a persons death certificate is shown the court will. Once theyve confirmed that you are listed in the will and are entitled to the property the same process as above will begin. B to pay off the deceaseds debts and liabilities if any.

Take the death certificate of the deceased as proof. In laymans terms an inheritance tax was executed in Malaysia under the Estate Duty Enactment 1941. Husband wants to transfer his property to wife.

These are the three things they will mainly take into account. Contributions by both parties either in terms of money. The rate of RPGT is illustrated in the following table.

Your will is automatically revoked upon your marriage or remarriage. The unexpected death of a husband or wife can be a harrowing experience for the surviving spouse. On the other hand if the deceased dies without leaving a valid will then a letter of administration instead of probate would be required.

A person who dies without a valid will known as the Deceased would be deemed to have died intestate. Procedure transfer of property after obtained grant of probate. Once the Executor obtained the Grant of Probate heshe has power to administer and distribute the property according to the.

After the Court has granted the Probate or Letters of Administration the personal representative that is the executor or the administrator will have to do the following. For West Malaysia and Sarawak the law governing the distribution of estate. An estate s of a dead person is liable to a 5 tax if it is valued above.

C to distribute the. If not careful the distribution under the law may be very undesirable to the deceaseds family. When is the most suitable time for making an application for the administration of the estate of the deceasedThe application can be made at any time after the death of the deceased.

SELLER QUOTATION FOR SUB. Movable property such as cash jewelry painting furniture computer etc are to be distributed by mere. TRANSFER OF PROPERTY MALAYSIA.

If the beneficiaryexecutor sells the property within 5 years the following RPGT rate shall apply. TRANSFER OF PROPERTY BY LOVE AND AFFECTION MALAYSIA. Property owned by Husband 50 shares and Wife 50 shares.

The delivery of properties to the beneficiaries depends on property type. Husband wants to transfer.

Wills And Probate Low Yow Law Firm

National Edition Alter Ego Trusts The Answer To Probate Fees Manulife Investment Management

Property Management After Death In Malaysia Propsocial

Characterisation Of Covid 19 Deaths By Vaccination Types And Status In Malaysia Between February And September 2021 The Lancet Regional Health Western Pacific

Can The Malaysian Government Take Your Property If You Asklegal My

Moving Forward In Probate Next Step After Extraction Of Grant Of Probate Or Letter Of Administration Malaysian Litigator

What Happens To Your Assets If You Go Without Leaving A Will

Pdf Determinants Of Attitude Towards Estate Planning In Malaysia An Empirical Investigation

How Do You Legally Transfer Property To Someone Else In Asklegal My

Wills And Probate Low Yow Law Firm

Can The Malaysian Government Take Your Property If You Asklegal My

How Do You Legally Transfer Property To Someone Else In Asklegal My

Wills And Probate Low Yow Law Firm

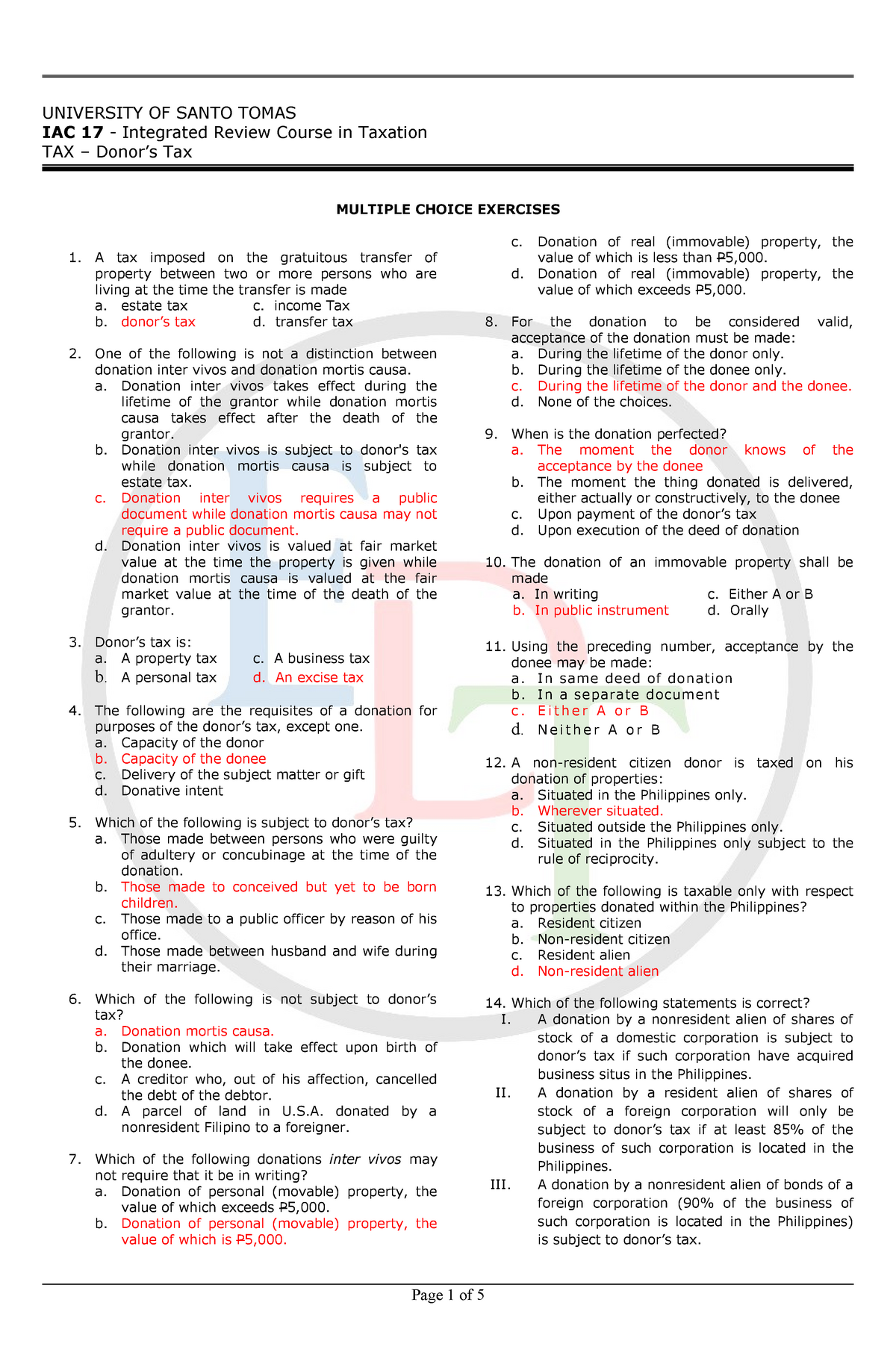

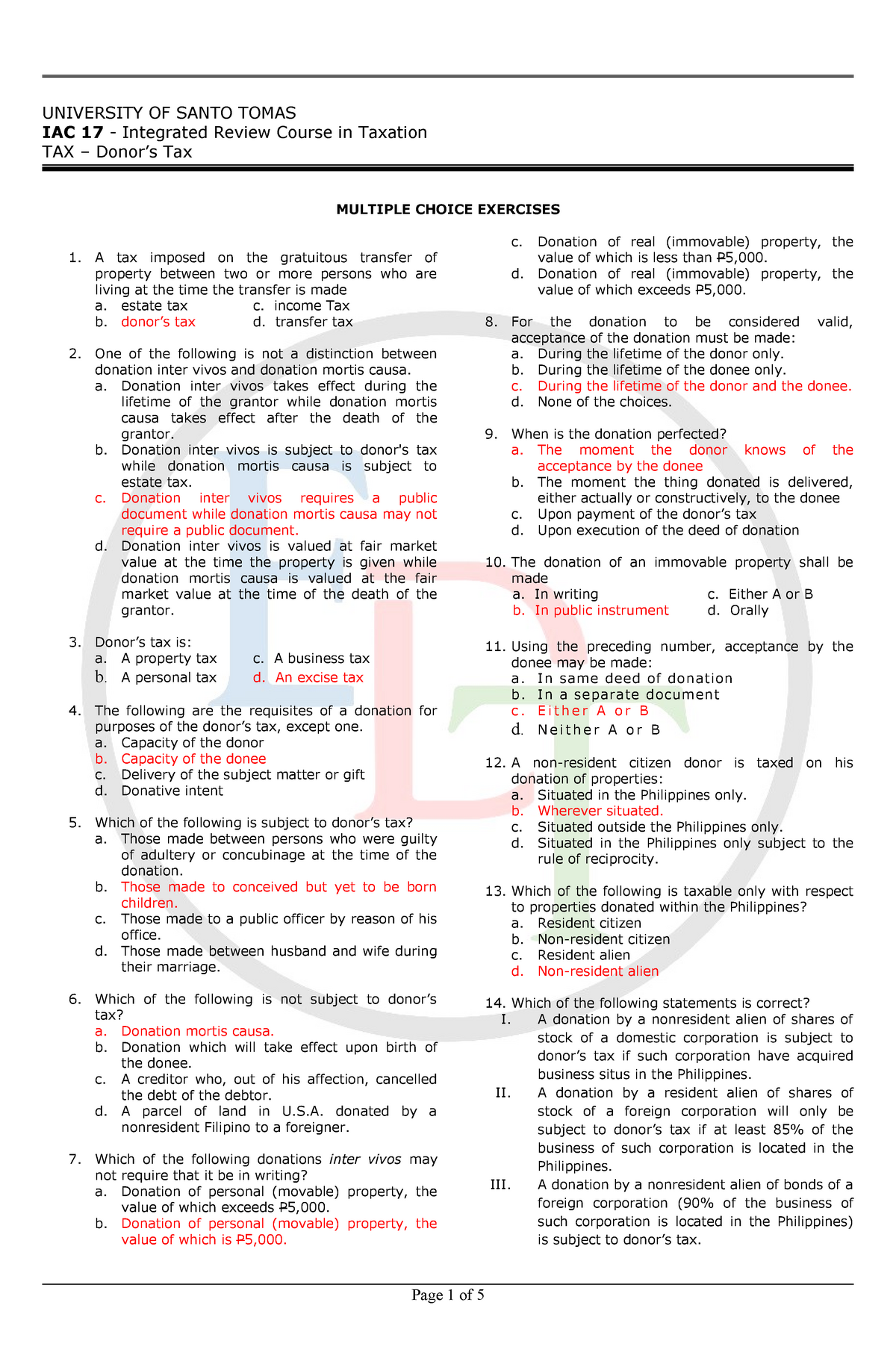

Donor S Tax Exam Answers University Of Santo Tomas Iac 17 Integrated Review Course In Taxation Studocu

The Transfer Of Property Deed Upon The Death Of The Spouse Ipleaders

How Does A Beneficiary Inherit Property Bequeathed To Him Her Upon The Death Of A Deceased Case Facts By Hhq Law Firm In Kl Malaysia

How Do You Sell A House If The Owner Is Deceased

Property Management After Death In Malaysia Propsocial